Taxes, accounting, law and more. All the key news for your business.

Two landmark judgments on the issue of abuse of rights are currently being widely discussed in the professional community.

The judgment of the Supreme Administrative Court 10 Afs 16/2023-78 stated that there was no abuse of rights as the subjective element of the abuse of rights test was not fulfilled.

According to the tax administrator and the decision of the Regional Court, this was an artificially created situation without economic justification and the taxpayer should have been assessed withholding tax on personal income.

The abuse of rights must involve both an objective and a subjective element:

Objective element – it consists in the fact that the application of the legal norm has not fulfilled its purpose (the tax advantage is or is not desired by the law).

Subjective element – the meaning and purpose of the transaction (or set of transactions) is to obtain a tax advantage by artificially creating conditions for its achievement (there is no proper economic reason for the transaction(s) or the economic reason is completely negligible).

The objective criterion of the abuse of law test was fulfilled when the partners (individuals), by carrying out the transaction, obtained money from the holding structure without paying tax. How was this achieved? Very simply put, the purchase price was paid for the sale of a business share (the sale of which was exempt to meet the time test), with the payment of the purchase price (part of it) financed by the funds raised by the profit share payment.

Fulfilment of the objective element is not sufficient for a conclusion on abuse of rights; the existence of the subjective element must also be proven.

However, according to the SAC, the tax entity has sufficiently explained the legitimacy and economic expediency of establishing the holding (other than tax). On the contrary, the tax authorities did not prove that the acquisition activity of the holding did not have its economic ratio and the same conclusions were wrongly adopted by the Regional Court in České Budějovice.

This case cannot be compared with the case in the judgment of the Supreme Administrative Court 6 Afs 376/2018-46 (ZexeZ), where there was clearly an abuse of law as the tax entity did not prove the economic meaning of the transactions.

The SAC confirmed that a holding structure diversifies risks, as its existence divides assets and business risk among several corporations that are part of the structure. It simplifies administration and concentrates decision-making processes at one level.

A holding is not regulated in the Czech legal system, therefore it is not possible to dwell on exactly what the parent company as a holding company “may and may not” do and the tax administrator should not base its conclusions on the type of holding. The holding company can only be an umbrella structure that does not have to manage the subsidiaries at all. It cannot be excluded that the nature of a holding may change over time.

The SAC recalled that a taxpayer may choose the most tax advantageous option from among various options, provided that it is not the sole reason for obtaining an illegitimate tax advantage.

The Supreme Administrative Court (SAC) concluded that the tax administrator emphasized only the tax purpose in the given case and all other claimed and documented reasons were marginal or were disproportionately disregarded and he did not prove his claim of abuse of law.

The second positive judgment of the Supreme Administrative Court 8 Afs 246/2022-61 shows us the view of the tax administrator, or where he can see abuse of law.

The Supreme Administrative Court (SAC) dealt with a case in which the tax administrator characterized a debt-push down transaction requested by a bank as abuse of a right - i.e. a transaction where the formal requirements are fulfilled, but the main objective of the transaction is to obtain a tax advantage.

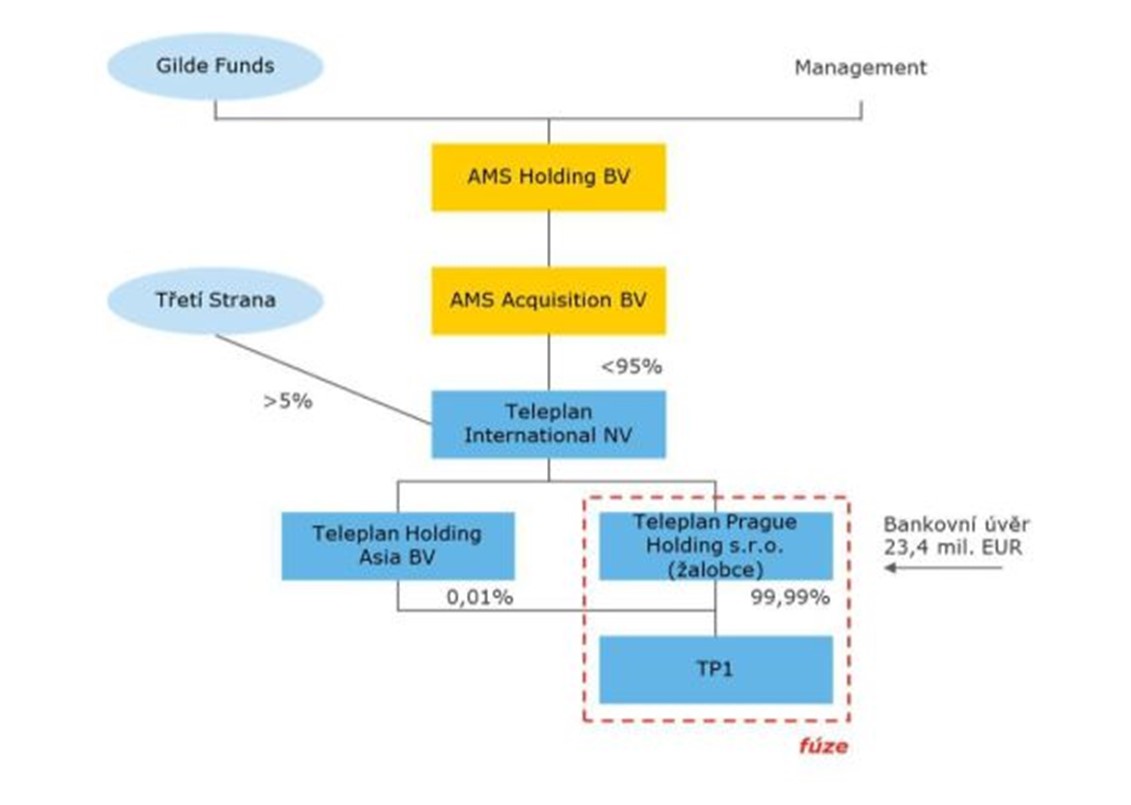

The SAC adopted the simplified scheme of the transactions described in the complaint:

(third party, plaintiff, bank loan)

According to the SAC, the transaction in question did not constitute an abuse of law and the taxpayer explained the economic rationality of the transaction, which was supported by the loan agreement. The merger was carried out at the request of the bank, which had as a condition for the repayment of the loan in question the transfer of part of it to the operating entity.

According to the SAC, it cannot be considered decisive that the transaction could also have been carried out otherwise, and not every request by a third party (in this case the bank) automatically excludes abuse of rights. In this case, economic rationality must always be well explained, which the taxpayer succeeded to do, or the tax administrator failed to refute in any way.

The bank’s requirements in the loan agreement played a key role. According to the SAC, the bank’s request to transfer the loan to the Czech operating entity was rational because it strengthened the bank’s position as a creditor. It is also economically rational that the investment group agreed to this demand, because without bank financing it would not have been able to make the acquisition either at all or only on less favourable terms.

The SAC therefore did not find the subjective element of abuse of rights and confirmed the deductibility of interest on financing.

It is no surprise to experts that tax authorities assess taxes for abuse of law (and lack of economic rationale) in virtually all more complex transactions related to obtaining a tax advantage.

Tax administrators thus assess taxes almost everywhere where they believe that the tax advantage was not intended by the law (it is “unfair” in their view) and they evaluate the subjective element necessary to assess tax on the grounds of abuse of law extremely strictly (i.e. tax administrators generally emphasize only the tax purpose and label all other claimed and documented reasons as marginal or disproportionately disregard them). Unfortunately, this strict assessment of the subjective element of abuse of rights has been supported by arguments from many Supreme Court judgments (especially where crown bonds were involved in the transactions).

These new judgments have finally begun the process of delineating the boundaries of the subjective element of the abuse of rights test, or rather, they provide guidance as to where the SAC – despite the existence of an “unintended” tax advantage – sees the economic ratio (and considers proven).

We are convinced that these judgments will inspire further positive decisions in the still very strict case law of the Supreme Administrative Court.

In conclusion, however, we must accentuate that the fulfilment of the subjective element of the abuse of rights test (as the name suggests) will in many cases be subjective and uncertain and will require a detailed and up-to-date knowledge of the case law of the SAC and a finger on the pulse of the times.

On the other hand, new rulings tell us that even relatively complicated structures with tax advantages can be defended if the economic (non-tax) reasons for their creation are proven.

If you are interested in more information, please do not hesitate to contact us.