Taxes, accounting, law and more. All the key news for your business.

As everyone has surely noticed, the development of cryptocurrencies has become a significant part of the financial markets in recent years. Investing, mining, staking, buying commodities or trading in cryptocurrencies is becoming increasingly popular among retail traders as well as among professionals. The trading of cryptocurrencies for the account and at the risk of companies that use double-entry accounting raises the question of their correct reporting.

The concept of cryptocurrencies under Czech accounting legislation

Czech accounting legislation does not currently contain specific regulations on the accounting and reporting of cryptocurrencies. However, there is a recommendation from the Ministry of Finance dated 15 May 2018, which is to account for and report cryptocurrencies as inventory “of a kind”.

In its current report “Information on the Tax Assessment of Transactions with Cryptocurrencies (e.g. bitcoin)”, the General Financial Directorate refers to a communication from the Ministry of Finance dated 15 August 2018.

The Ministry of Finance of the Slovak Republic defines purchased cryptocurrency as short-term financial assets valued in the same way as securities held for trading. Self-mined cryptocurrencies are recorded only on the off-balance sheet and are measured at fair value at the time of use.

According to the Czech National Bank, cryptocurrencies, e.g. bitcoins, are neither non-cash funds nor electronic money, nor do they exhibit the characteristics of an investment instrument because they do not have the nature of securities or derivatives.

The issue of cryptocurrencies is not yet regulated by International Financial Reporting Standards (IFRS) either, but according to IFRS, companies must apply accounting methods used for similar transactions to areas not directly regulated by the standards, so that the financial statements present a true image of the economic reality. The decisive criterion is the purpose of acquiring cryptocurrencies. It is important to understand the nature and characteristics of cryptocurrencies as well as the business activity of the company. Proper understanding will enable more accurate application of accounting methods and approaches. The most appropriate standards are IAS 38 Intangible Assets and IAS 2 Inventories.

IAS 38 – Under this standard, intangible assets are defined as follows:

Cryptocurrencies may be traded at an exchange or in peer-to-peer trades, thus meeting the first condition of the IAS 38 definition. The value of cryptocurrencies is not fixed or determinable, but is subject to high volatility resulting from the clash of supply and demand in the financial market and therefore cannot be accurately predicted. For this reason, it is not monetary but non-monetary in nature.

In summary, as cryptocurrencies meet both conditions for the application of IAS 38, we believe it is most appropriate to apply IAS 38 in accounting for cryptocurrencies under IFRS. IAS 38 allows two potential accounting treatments for accounting transactions with intangible assets:

Note IAS 13 defines an active market as one, in which a sufficient number of trades occur at a regular frequency for price information to be adequate.

IAS 2 – Depending on the nature of the entity’s business, it may be appropriate to apply IAS 2. This could be the case when an entity holds cryptocurrencies for the purpose of selling them in the ordinary course of business. Examples include traders, brokers, exchanges and stock exchanges.

A different approach would be applied to capture revenues and costs in the case of mining under a “proof of work” mechanism, where miners are rewarded with cryptocurrencies for creating a new block on the blockchain, or in the case of staking under a “proof of stake” mechanism.

The issue of accounting for cryptocurrencies in the Czech Republic is also being discussed by the National Accounting Council, which is currently preparing an interpretation that should complement and extend the above-mentioned general recommendation of the Ministry of Finance of the Czech Republic.

As there is no specific accounting standard related to cryptocurrencies to date, we can expect more specific global reporting standards in the future.

In the Czech accounting environment, cryptocurrencies are generally perceived and accounted for as inventory, so it is necessary, among other things, under article 29 paragraph 1 of Act No. 563/1991 Coll., on Accounting (hereinafter referred to as the Act), to perform their inventory-taking. For cryptocurrencies, this requirement can be met quite easily. Due to their specific functioning and storage, it is possible to retrieve their status and value from e.g. electronic wallets or hardware wallets. In addition, account statements from cryptocurrency exchanges may be used.

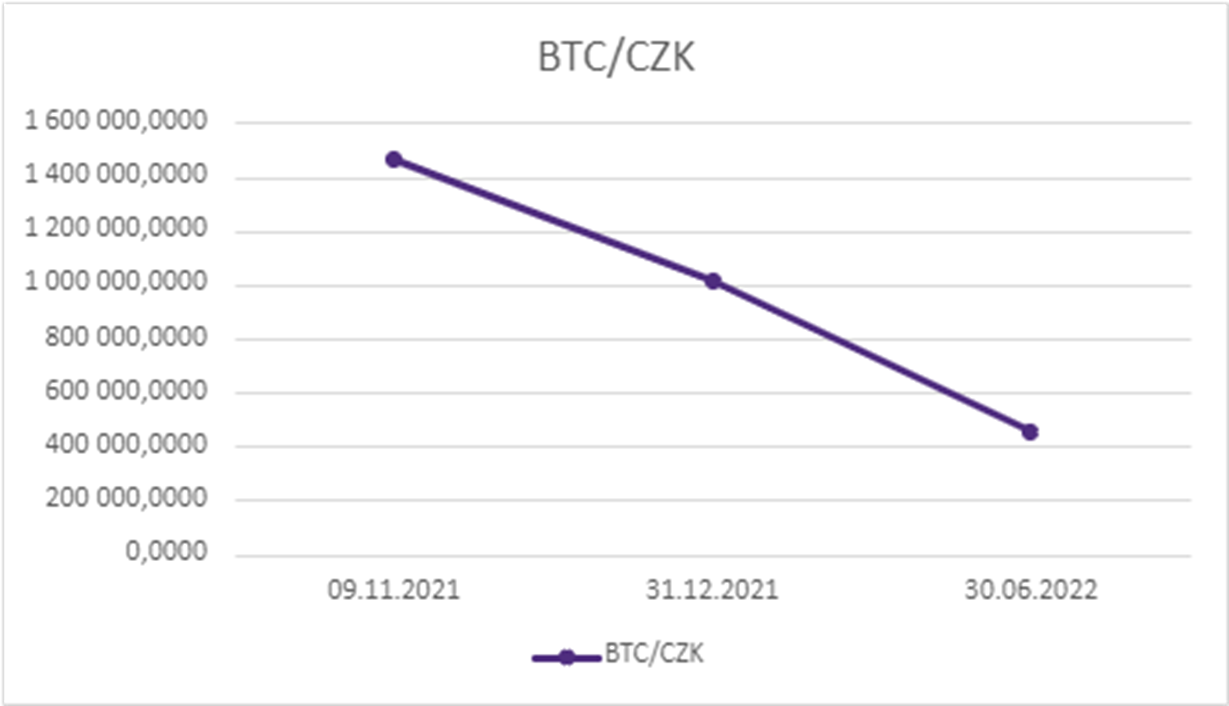

The table below shows the rates on selected days for the top 5 cryptocurrencies according to market capitalization. Market capitalization expresses the market value of cryptocurrencies, so it is the product of the number of cryptocurrencies in circulation and the current market price.

The following table shows the rates as of 9 November 2021, when cryptocurrencies reached their highest historical values, the rates as of 31 December 2021, i.e. the values of cryptocurrencies as of the balance sheet date within the calendar year, as well as the rates as of 30 June 2022, i.e. the date when the market price of cryptocurrencies was negatively affected by global macroeconomic factors.

| 09.11.2021 | 31.12.2021 | 30.06.2022 | |

| BTC/CZK | 1 472 825,84 | 1 020 062,58 | 458 542,54 |

| ETH/CZK | 104 870,84 | 81 100,38 | 26 035,85 |

| BNB/CZK | 14 253,66 | 11 272,32 | 5 199,02 |

| ADA/CZK | 46,35 | 28,77 | 11,03 |

| XRP/CZK | 27,86 | 18,27 | 7,81 |

The chart below shows the price development of the most famous cryptocurrency, Bitcoin.

Under article 7 of the Accounting Act, companies are required to prepare financial statements in such a way that they give a true and fair view. A representation can be considered fair only if the items in the financial statement correspond to the actual situation. In the Czech environment, we are in the area of inventory, and therefore it is necessary for the accounting unit, in the case of a negative difference between the actual (fair) value and the book value, to reflect this fact in the financial statement. However, for volatile assets such as cryptocurrencies, it may not be easy for an entity to determine the correct methodological approach for valuating cryptocurrencies as of balance sheet date.

If you are unsure as to how to handle cryptocurrencies, how to account for them, how to valuate them, take inventory and report them so that you could prepare financial statements that present a true and fair view, we believe that we are able to offer professional consulting services in all of these areas and will be happy to work with you individually to address specific issues and cases.

The background and experience of the global consulting group Grant Thornton allows us to respond flexibly to the needs of our clients in all consulting areas comprehensively – accounting services, auditing services, legal services, tax advisory services as well as expert and valuation services.

Author: Ladislav Zíta