Petr Němec | 22.11.2024

Financial Statements for 2024 and Top-Up TaxesTaxes, accounting, law and more. All the key news for your business.

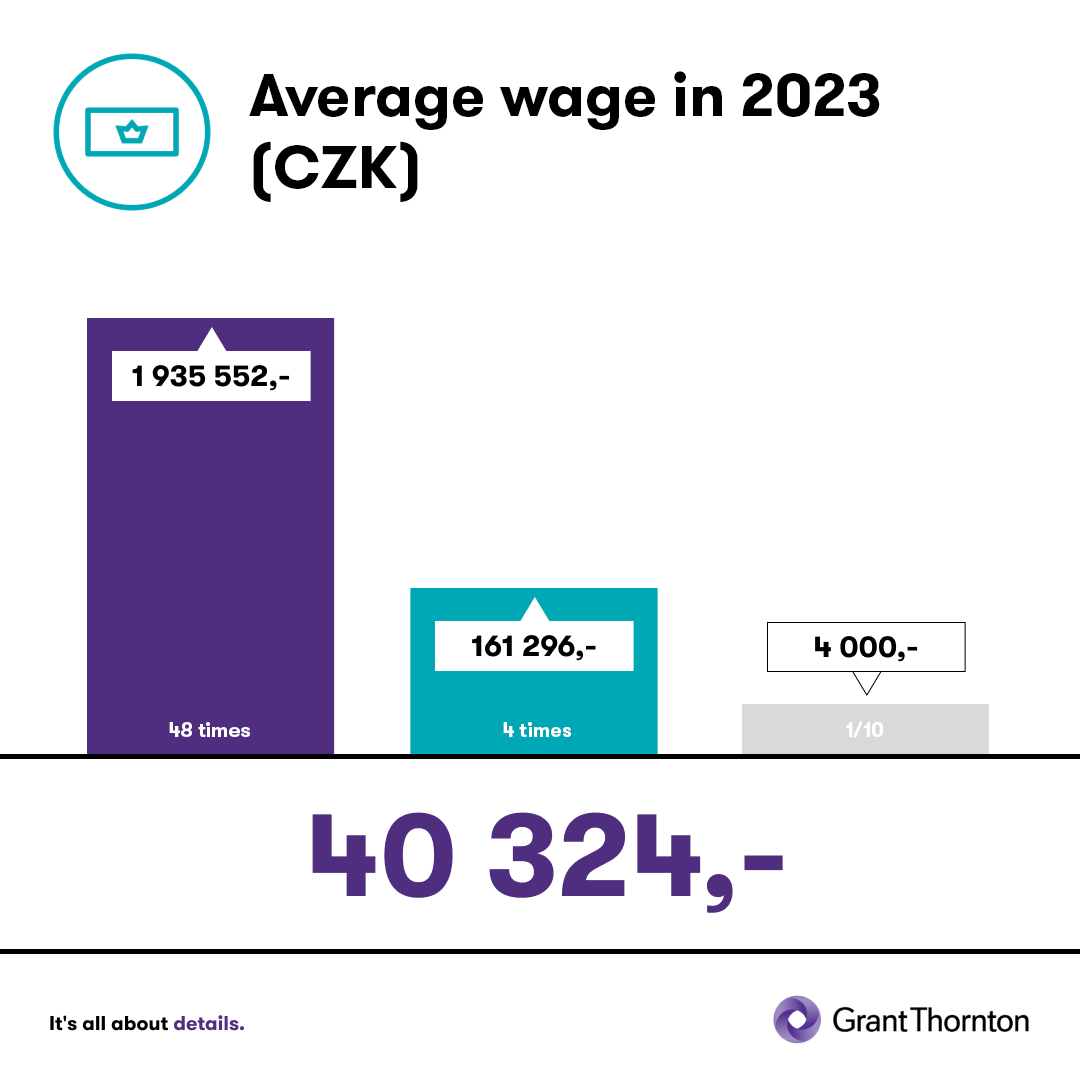

Based on Government Decree No.290/2022 Coll., on the amount of the general assessment base, the conversion coefficient for adjusting the general assessment base for the year 2021, the reduction thresholds for determining the calculation base for the year 2023 and the basic pension assessment set for 2023, the average wage for 2023 was set at CZK 40,324.

Act No. 586/1992 Coll., on Income Taxes (hereinafter referred to as “ITA”) refers to the value of the average wage when calculating advances for employment tax and when calculating the tax. According to article 38h of the Income Tax Act, the advance payment is defined as a 15% advance payment rate up to 4 times the average wage, which for the year 2023 reaches CZK 161,296. According to article 16 of the ITA, an advance payment is defined as a 15% tax rate for the part of the tax base up to 48 times the average wage, which reaches the amount of CZK 1,935,552 for the year 2023.

In addition, the threshold amount for employees’ participation in sickness insurance is based on the average wage. The threshold amount is the value of one tenth of the average wage rounded down to the nearest five hundred korunas. The Income Tax Act “works” with the threshold amount for employees’ participation in sickness insurance in the provisions of article 6 paragraph 4 letter b) in connection with income from dependent activities without a Declaration of the taxpayer liable to personal income tax from dependent activity, where the taxpayer withholds personal income tax from income from dependent activities by withholding according to the special tax rate under article 36 of the Income Tax Act from income in an aggregate amount not exceeding the threshold amount for employees’ participation in sickness insurance for the same taxpayer for a calendar month. 1/10 of the average wage rounded down to the nearest five hundred korunas for the year 2023 reaches CZK 4,000.

Author: Roman Burnus, Valérie Kovářová