Taxes, accounting, law and more. All the key news for your business.

Renata Dudášová | | October 10, 2023

Today’s article will focus on the commission contract and its recognition in the accounting of an accounting entity. This is one of the types of commercial contracts that we may encounter in practice.

A commission contract is a contract between two parties, by which the principal (the person offering goods or services for sale) and the commission agent (the person commissioned to sell goods or provide services on behalf of the principal) agree on the terms of the sale of goods or services. The commission agent is bound by this contract to procure for the principal, on his account but on his own behalf, a certain matter, for which he is entitled to remuneration.

The most common case, in which a commission contract is made, is a sale. It can be the sale of own products, goods or services, where their sale is mediated by another business entity. Until the goods or product are sold to a third party, i.e. the customer, the title still belongs to the principal. The commission agent does not become the owner of the transaction at any time, but acts as an intermediary between the seller and the buyer.

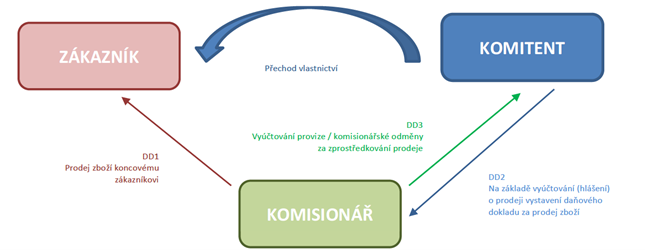

(Client – Commission Agent – Principal

transfer of ownership

DD1 sale of goods to the end client, DD2 issuing a tax invoice for the sale of the goods on the basis of the sales invoice (report), DD3 billing of commission for mediation of the sale)

The commission agent acts only as an agent of the principal and acts on the principal’s behalf. The commission agent does not bear the business risks or benefits of the performance. He is liable only for the commission service provided, which he should perform in the interest of the principal. The commission agent, as stated above, does not become the owner of the goods or services provided and therefore does not account for them in his cost and revenue accounts. The principal remains the owner until the goods are sold/provided.

Section 7 of Act No. 563/1991 Coll., on Accounting, states, among other things, that “accounting units are obliged to keep accounts in such a way that the financial statements prepared on the basis thereof give a true and fair view of the subject matter of the accounts and the financial position of the accounting unit”. The commission agent’s income is therefore only the remuneration agreed in the commission contract, and therefore the commission agent recognises only the commission in its income accounts. If the commission agent were to recognise the entire transaction in its income and, at the same time, reflect the transaction in its costs, both the cost area and the income area would be overstated.

In case a commission agent takes goods from a principal for sale on consignment to its warehouse, it records those goods only in its off-balance sheet accounts.

The issue of the Commission Contract is also addressed by the National Accounting Council in its Interpretation No. I-7.

If you need advice on setting up and accounting for a commission business model, we can offer you our services in this area, including advice on specific cases and suggesting the most appropriate solutions for your business transaction.

Author: Renata Dudášová, Thao Phuong Nguyen