Taxes, accounting, law and more. All the key news for your business.

| | January 30, 2025

The high tax burden on labour in the Czech Republic, despite the fact that we have one of the lowest personal income tax rates in Europe, is repeatedly confirmed by comparative OECD tax statistics. A stumbling block in the Czech tax system is the established tradition of high health and social insurance contributions (hereafter also referred to as “social security contributions”). The last significant reduction in social insurance rates occurred 15 years ago in the context of the so-called green tax reform. Since then, the amount of levies on employment income has changed only slightly on the employer’s side. We are currently facing an increase in the social insurance rate for employees and an increase in the insurance contribution base for entrepreneurs. The big disadvantage of these so-called hidden taxes is that they are absent from any option for claiming deductions or credits from these levies and that they are not subject to progression, which in practice means a low levy burden on high-income taxpayers and a high levy burden on low-income taxpayers.

The most common form of gainful activity in our country is employment or a sole proprietorship business. Therefore, in the context of the times we are in and the high levy burden, the question arises whether it is appropriate to consider a choice between these activities. In this article, we will therefore attempt to summarise a number of useful economic considerations, including a practical comparison of the income tax burden under both options. All this in the context of the current tax and labour legislation.

In order to compare whether it is profitable to be employed or to run a business, we have to look at the background that the challenging times of the last four years have brought us. During this period, the unfavourable economic situation of our country led to a change in the budgetary policy of the state. Fiscal and monetary stimuli to the economy, together with a number of non-pandemic related tax measures, have had a negative impact on the overall public debt. Significant tax measures included the abolition of the solidarity tax increase, the abolition of the super gross wage, the introduction of a flat-rate tax for self-employed persons and the abolition of the tax on the acquisition of immovable property. All of these changes had tax implications starting in 2021, the time when our country was dealing with the covid-19 pandemic. On the one hand, these changes helped the citizens in a difficult situation, but on the other hand, they have caused a serious impact, lowering the state budget revenues. Measures linked to the war in Ukraine have resulted in further increases in government spending, and high inflation has in turn pushed up energy, food and housing costs. All this together has led to a final decline in the economic activity of the population. Our economy was facing a problem with the labour market and the long-neglected need to reform the pension system was also beginning to be recalled. Add to this the depleted health care system after the turbulent covid era and the question of the sustainability of the current level of spending in social systems.

A response to the economic situation soon came from the government in the form of the so-called consolidation of public finances. The solution to all these problems was to be an intervention in the most important item on the revenue side of the budget – the taxes. The question was whether the changes would be radical enough to help. The aim of the tax consolidation package was to cover the increased expenditure, but also to adjust our tax mix, i.e. the composition of taxes. For a long time, international institutions have been recommending to us to put emphasis on taxation of consumption or possession of real estate as hidden, or better publicly acceptable instruments to increase the state budget revenues. The remedial measures resulted in a 2% increase in the corporate tax rate, followed by massive changes in the taxation of employee benefits. Social insurance contributions are also rising, both through an increase in the rates for premiums paid by employees and through a gradual annual increase in the minimum assessment base for self-employed persons’ premiums to a targeted 40% of average wages by 2026. The overall impact of the measures in the consolidation package is yet to be assessed retrospectively, but let us prepare ourselves for the fact that the unpopular restrictive policies of our government may continue for some time to come.

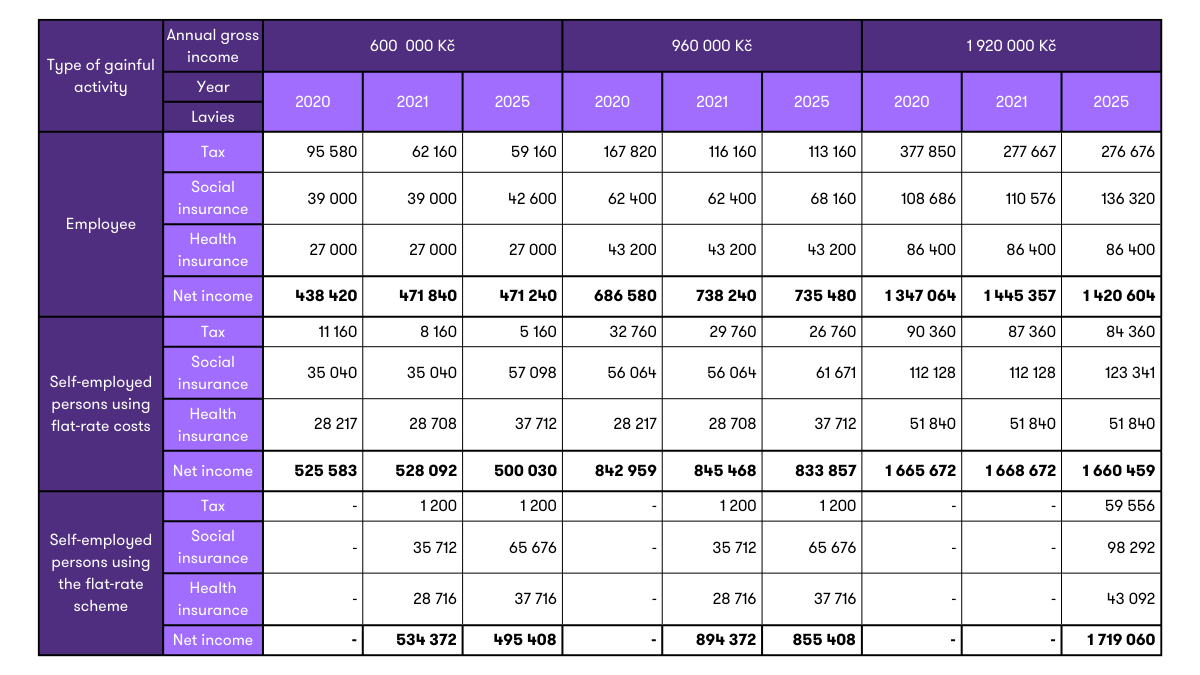

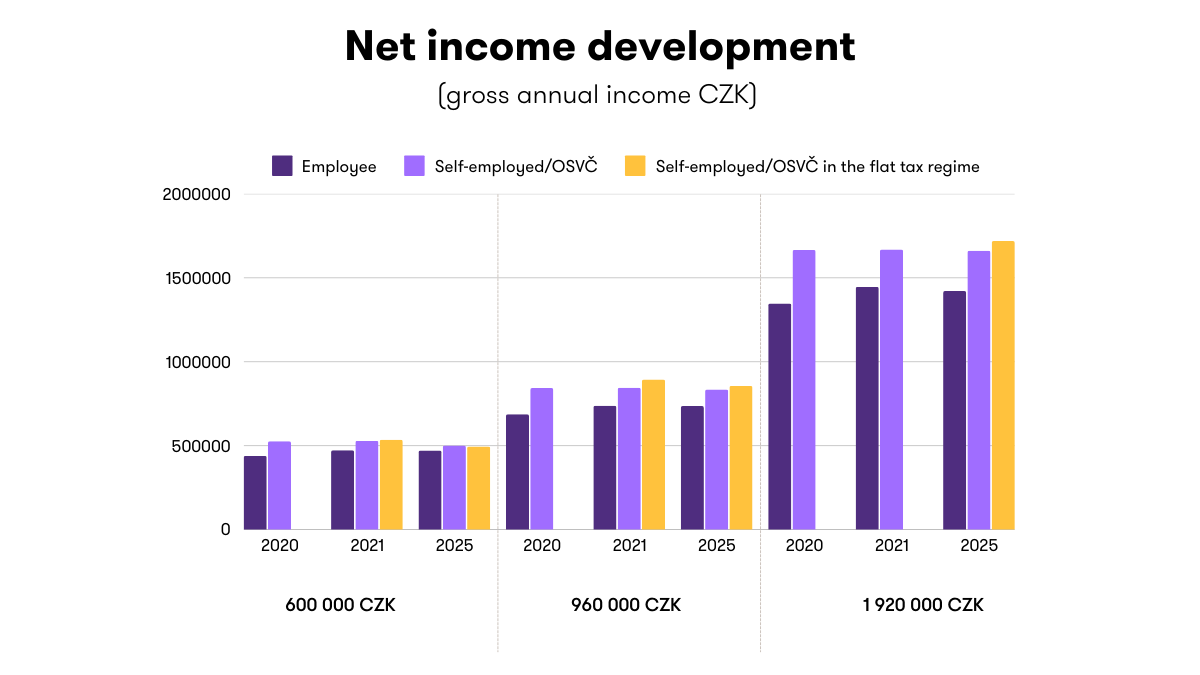

In Czech conditions, we most often encounter an employee or a sole trader with a 60% flat rate (also referred to as “self-employed” or “entrepreneur” in the article). The illustrative table shows the impact of levies on the net income of an employee and a sole trader in the context of tax changes in 2020, 2021 with a view to 2025. The table shows the impact of three important tax changes. The first is the abolition of the solidarity tax increase in favour of the introduction of a second tax band (progression). The second is the abolition of the super gross wage for employees and the third is the introduction of a flat-rate tax for self-employed persons.

The figures also reflect an increase in the social security contribution rate or changes in the minimum assessment base for health insurance premiums. In order to make the impact on the net income of employees and self-employed comparable, we consider income on an annual basis in three levels. Monthly, there are the amounts of CZK 50 thousand, CZK 80 thous. and CZK 160 thousand.

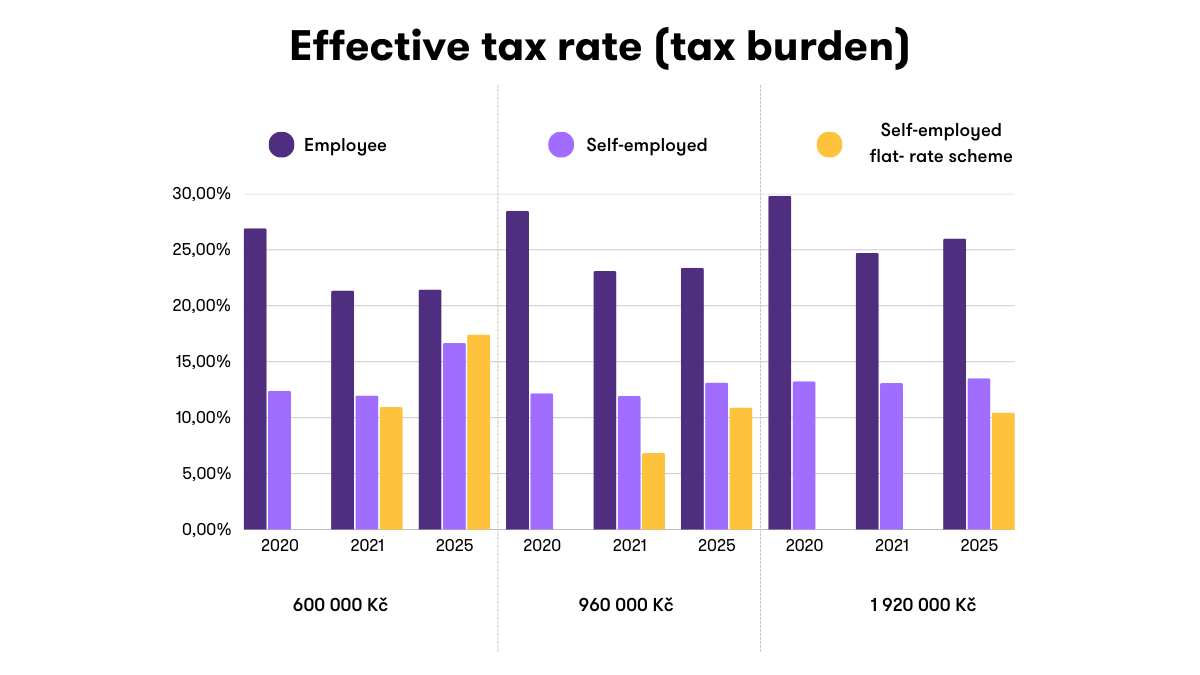

The impact of the levies on net income is evident from the figures at a glance. In addition to the difference in net income, if we are also interested in changes in the tax burden on employee and self-employed income, it is practical to compare taxes and levies against total gross income (the “tax burden”). We can thus better answer the question of whether the tax burden of both gainful activities has moved closer to one another or further apart over time due to the changes.

We can see that the tax burden on employee income fell by around 5% over the years under review as a result of the abolition of the super gross wage and the replacement of the solidarity tax increase with a progressive two-band tax. On the contrary, the overall contribution burden of employees has increased slightly in the last two years as a result of the increase in the premium rate to 7.1% and the significant increase in the maximum assessment base for the contribution. The ratio of social contributions to the total tax burden is increasing.

Our illustrative example shows that the declared objective of affecting high-income subjects by a solidarity tax increase or progressive taxation does not have a significant impact on entrepreneurs with a high level of income. The low tax base due to the possibility to apply high flat-rate expenses remains an unbeatable advantage for business. The impact on the increase in the total levy burden of the entrepreneur will be significant in 2025, when his net income from business will be lower as a result of the consolidation package. The example shows the impact of increasing the assessment base for social insurance from the historical 50% to 55% of the tax base. As a result of this increase, an entrepreneur with a relatively low income is obliged to pay social security contributions on a much higher assessment base than his actual assessment base. Moreover, the jump in the average wage between 2021-2022 and 2023-2024 has caused an increase in the minimum assessment base and the health insurance contribution base. This has an impact particularly on annual revenues up to CZK 600 thousand, where the minimum assessment base for health insurance forces entrepreneurs to often pay from a higher base than their actual income.

Compared to employment, the tax burden on the income of self-employed persons is significantly lower, although it has been slightly approaching the tax burden on the income of employees over the years. An entrepreneur with an annual income of CZK 600 thousand even has the tax burden on income just under 5% lower than that of an employee in 2025. For higher income, the difference in tax burden is around 11-12% on average .

As far as the flat-rate tax is concerned, in 2021, when it was introduced, this regime was highly favoured compared to the regular regime – the chart shows that self-employed persons with income of CZK 960 thousand could benefit most from the flat-rate tax. This advantage was subsequently mitigated by the amendment introducing three bands for flat-rate advances. Nevertheless, the tax burden of self-employed persons in the flat-rate regime is about 2-5% lower than that of self-employed persons in the regular regime, especially with higher income.

However, when comparing the flat-rate scheme with employment, the difference in tax burden is significant. An entrepreneur with an annual income of CZK 1,920 thousand, which corresponds to a monthly income of CZK 180 thousand, may have an income tax burden in 2025 that is up to 15% lower than if he were employed.

For the sake of completeness, it should be mentioned that an entrepreneur should consider a flat tax in 2025 if he or she has little capacity for complex administration, has minimal or no tax deductions or tax credits and his or her gross annual income is between CZK 680,000 and CZK 2 million. In such a case, the flat-rate scheme pays off significantly for the entrepreneur in the total levies. However, watch out for the impact on the pension, which will be lower in the case of a flat-rate tax, as the assessment base in the flat-rate scheme is in most cases lower than the actual assessment base.

It can be summarised that the income tax burden of employees and entrepreneurs has converged over the years, although entrepreneurs still have a significant advantage over employees due to tax instruments. However, the gap between the two categories of economically active citizens is not widening any further; on the contrary, the tips of the scissor blades are getting slightly closer to one another. The calculation shows that an entrepreneur with an income of CZK 80 thousand a month therefore has a significantly lower tax burden than an employee with the same gross income, so it is not surprising that employees consider changing their earning activities in favour of entrepreneurship and moving into the Schwarz system zone.

But what about the other economic factors that may influence the decision as to which option is preferable? There are a number of areas beyond the effective tax burden that need to be considered. Below, we list at least the most important ones, although to a large extent it also depends on subjective factors that cannot be fully captured in their complexity.

In practice, we encounter a number of factors that eventually lead citizens to decide to become self-employed. This may be not only the employee’s internal motives, but also the influence of the employer himself, who, due to the high cost of work, forces the employee to work outside the employment relationship and work “on his own”.

The Schwarz system can be defined as illegal employment in the form of covering an actual employment relationship with another contract. Illegal work is defined by Act No.435/2004 Coll., on Employment, as the performance of dependent work by an individual outside an employment relationship.

The performance of work on the basis of contracts made under the Commercial Code or the Civil Code is not completely excluded in Czech conditions, but if the performance of the work in question meets the characteristics and conditions of dependent work or if it is typical of professions that are performed in an employment relationship, there is a risk of reclassification of such a relationship as dependent work under the Employment Act, with sanction consequences for both the employee and the employer. It should be noted that the length of the work is now irrelevant for the assessment of whether or not it is illegal work. This eliminates one of the most common employer arguments about the short-term nature of the worker’s activity, which the Labour Inspectorate has often heard during its inspections.

The case law of the Supreme Administrative Court also mentions that in order to assess the legal relationship between two entities as a business activity, not only the condition of both the nature of the activity (i.e. the work is not purely dependent, but also shows signs of independence), but also the condition of voluntariness, i.e. the absence of coercion, must be met. Therefore, if it turned out that the employee had been forced to work as a self-employed person, the labour inspectorate would consider such a situation to be the performance of illegal work, even if the nature of the work was of ambivalent nature. Note also the new trend in court case law that holds managers personally liable for the company’s Schwarz system.

From a tax and national insurance perspective, the problem of the Schwarz system is not as significant as it used to be, but it is still necessary to be wary of activities that are typically carried out in an employment relationship (e.g. working in a supermarket). Largely due to the sophisticated case law in this regard, the tax administration currently accepts the free will of the parties to choose whether to enter into an employment or commercial relationship, and then accepts the chosen regime of taxation of income from the activities in question according to this decision.

Employment, as opposed to a business, brings a number of benefits to the employee that the employer provides to him/her in addition to the wages. These benefits not only strengthen the employee’s sense of belonging to the company and motivate the employee to better or at least stable performance, but they also make life more pleasant for the employee or his/her family members or reduce their personal expenses. Employees appreciate both benefits that are nowadays a standard supplement to their employment income and benefits that are unusual with the possibility to choose according to their needs. Typical benefits include, for example, a meal allowance or pension savings products, flexible working hours, training, team building and employer-organised parties. Home-office is also becoming a common benefit. Above-standard benefits include, for example, temporary accommodation, a company car for private purposes or benefits from the category of leisure activities such as culture, health, education (i.e. private health care, recreation, school fees for the employee or his/her children, etc.). Nowadays, there is a whole range of options available to employer and the employee in this area. In terms of taxes and insurance premiums, the benefits are treated in such a way that they remain a benefit for employees, even after the legal restrictions imposed by the consolidation package, which introduced a limit of half of the average annual wage for leisure benefits and one average annual wage for health benefits. In most cases, employee benefits should not have additional tax implications, or employers try to stay within the amounts limited by law to limit their premium costs.

On the other hand, the entrepreneur also has the opportunity to invest his or her spare funds in personal benefits, and probably more efficiently and attractively than the employer. However, he is still investing out of its disposable income, while the employee receives benefits over and above his regular salary “for free”.

Another important area to consider when deciding between employment and entrepreneurship are the so-called labour law protection safeguards. These measures take into account both the employee’s work and personal situation and are legally enforceable. They derive from the Labour Code and are likened to an insurance policy in that the entitlement to payment occurs when a defined event occurs. These are the so-called wage benefits, which include, for example, extra pay for overtime work, night work, work on holidays or weekends, in difficult working environments, and on-call work. In addition, paid holidays, notice period including severance pay, compensation in case of work-related injuries, travel allowances in case of business trips, reimbursement of expenses upon employment or in case of temporary assignment, etc., are also an above-standard wage advantage compared to enterprising.

In addition to the Labour Code, the employer is also obliged to comply with extensive legislation in the area of occupational health and safety (“OHS”). Due to this obligation, the working environment and conditions for the employee’s work, including the impact on his health, are much more monitored than for the entrepreneur, who bears these risks on his own responsibility.

In addition, compulsory social contributions from wages also make it easier for employees to access health insurance benefits such as nursing or long-term care, sick pay, maternity or paternity pay. The entrepreneur must consciously prepare for the entitlement to these benefits in advance by paying voluntary sickness insurance.

The employee bears a lower risk of losing the permanence of his income compared to the entrepreneur, as his income is de facto protected by legal “safeguards” unlike that of the entrepreneur. However, these safeguards are so expensive that neither the employer nor the social security system wants to bear the cost, so they tend to be passed on to the employee’s wages. The employee chooses a safe employment option with the expectation that he or she will be income secure in the event of illness or injury. However, the consequence of hedging the risk of loss of income is that his current disposable income is lower because the employer notionally makes a provision for these risks out of his wages by setting the wage at a lower level. In a way, the employee is himself prepaying the protection of his or her own personal risks and may perhaps not always be fully aware of it.

Safeguards of protection by the Labour Code or social security thus significantly increase the cost of an employee’s wages. The employee’s wages are thus burdened with the costs of the social security system, the employer’s costs of maintaining the continuity of his wages in the event of “insurance” events, and the employer’s costs of OSH.

Entrepreneurs also shoulder a number of personal and economic risks. As they do not benefit from these protection mechanisms, they face risks of financial insecurity in the event of sudden personal or health emergencies, are not protected in the event of difficult working conditions, etc. However, because they voluntarily bear these risks, their income is not as burdened as that of employees and is therefore higher.

The problem tends to be when entrepreneurs do not look too far into the future and do not build up a reserve for future sudden situations. The fact that they do not build up savings, and thus often exceed their actual limits at the expense of their future, in fact only reflects the fact that they are not as secured in this respect as employees who are essentially forced by the system to behave in this way.

At first glance, an employee may not realise that the amount of his wages is affected by a number of other costs of his employer. In addition to the aforementioned health and social insurance contributions, which the employer pays into the system both for the employee and for itself, these are also the employer’s operating and overhead costs for the provision of its business activities. For example repair, maintenance of assets, raw material costs, rent, administrative expenses, energy, insurance, cleaning of premises, personnel costs including salaries and social security contributions of other employees, remuneration of members of the statutory bodies, remuneration of shareholders, etc. The entrepreneur, unlike the employee, can correct the impact of these costs on his income and can easily plan and decide on the business risk he is still willing to bear, or consider the unprofitability of the business and close his activities. Thus, he has more power to decide the amount of his disposable income than an employee. But let’s not forget that entrepreneurs, on the other hand, are liable for their business with all their assets and their income depends on payments from business partners. The employee is exempted from such influence, as his wages are guaranteed by the Labour Code regardless of his employer’s reimbursed contracts.

Entrepreneurs are exempted from paying advance tax on a monthly basis (unless they are in the flat-rate regime), which also increases their disposable income. In addition, the option to claim expenses against their income when determining the annual tax base gives the entrepreneur additional room for manoeuvre in how to handle their money. Employees do not have this option. Particularly in sectors where actual expenditure is very low (e.g. accounting services), the possibility of claiming high flat-rate costs gives a lot of scope for further investment of the funds made available.

Another advantage of entrepreneurship is that our pay-as-you-go pension system amply covers the low pension of entrepreneurs through employee and employer contributions. It is their contributions that make up the majority of the income of the Czech pension insurance system. Current employers thus subsidise the pensions of existing pensioners with their high insurance burden, including entrepreneurs who contribute less to the pension system due to the design of their pension assessment base.

The personal assessment base for calculating an employee’s pension is based on the average of the employee’s gross monthly earnings for the relevant period. The personal assessment base of entrepreneurs for the calculation of pensions is based on the average of the annual assessment bases. From 2024, the taxable base of an entrepreneur is set at 55% of the tax base (income less expenses). Both bases are then further adjusted for inflation and reduced according to the solidarity principle. However, it can be seen that the pension percentage is calculated on a base 78% lower than the employees’ pension base in the case of a self-employed person applying the 60% flat-rate costs.

Currently, the base for insurance contributions of self-employed persons is gradually increasing, which should correct the disproportion between employees and entrepreneurs. The way to a higher pension would be to set a higher annual assessment base for social security contributions. The ideal level of the annual assessment base should then be 44% of the annual average wage, which is currently the first reduction threshold for pension calculation. This amount corresponds to an income of approximately EUR 94,000 per month. Although the earnings credit in the first reduction threshold will decrease over the years as a result of pension reform, it is still advisable to increase your annual assessment base. Due to the increase in the minimum assessment base for insurance contributions to the target 40% of the average wage in 2026, the total burden of the increase in the annual assessment base should be spread evenly throughout the year. However, not every entrepreneur can afford to pay this increase and the final amount of the pension will also be affected by a number of other factors arising from the design of the pension calculation itself (excluded periods, employment, etc.). Income between the 1st and 2nd reduction thresholds is counted for pension purposes only about one quarter of the time, so setting your assessment base at a higher level is meaningless.

In view of future demographic developments, it is advisable to advise both employees and entrepreneurs to take their old-age security into their own hands and not rely solely on the state. In other words, to look for ways to make their own private pension reform.

The choice between running a business or getting a job is largely influenced by subjective factors. In addition to considering the above areas, much depends on each person’s personal foundation. Some people are sensitive to personal risk, and so prefer to opt for lower income in a job with security. The more adventurous will take higher risks and follow the path of entrepreneurship for higher revenues.

Employment includes, but is not limited to, the following advantages and disadvantages:

Entrepreneurship, on the other hand, can offer the following advantages and disadvantages:

We have looked at a number of factors that can play a role in the decision between employment and entrepreneurship. Of course, in typically dependent occupations, the Employment Act must be respected as to what is and is not illegal work. However, due to the increasing benevolence of the courts and the tax administration towards the choice of contractual relationship for other professions, the Schwarz system is no longer an issue in today’s conditions. The Schwarz system is overly taboo. It is purely a choice of the parties with all the advantages, disadvantages and risks that the respective choice entails, not a sham invoice job that would conceal an actual employment.

It will always be a quid pro quo. Although employees are more protected by legislation than entrepreneurs, this protection is reflected in their lower wages and, in addition, in higher total levies on gross income. However, the advantage of employment is generally not measurable – it depends on the subjective preferences of the individual employee whether it is more valuable to be protected by the Labour Code with all the other benefits or to have a higher net income in a bank account.

Entrepreneurs benefit from a policy of support for small traders in the form of flat-rate expenses. We personally agree with this policy. Any incentive to promote entrepreneurship is not seen as discrimination, but as an incentive that helps to turn the imaginary wheels of the economy. We are glad that we have small traders in our conditions. We consider them to be a historic and distinctive pillar of our society. Their higher net income compared to employees is offset by the business risks they face and the fact that the Labour Code does not protect them in difficult times. Entrepreneurs also bear a higher risk of having to fend for themselves in old age due to the often low personal assessment base for calculating the old-age pension.

Taking into account all the advantages and disadvantages of both structures, it is impossible, in sports language, to clearly identify a winner. The winner can be both an employee or a self-employed person. It depends on the subjective perception of the unmeasurable values of the individual person. In purely mathematical terms, the self-employed wins if they realise a higher net income than an employee for the same gross income.