Petr Němec | 22.11.2024

Financial Statements for 2024 and Top-Up TaxesTaxes, accounting, law and more. All the key news for your business.

| June 1, 2021

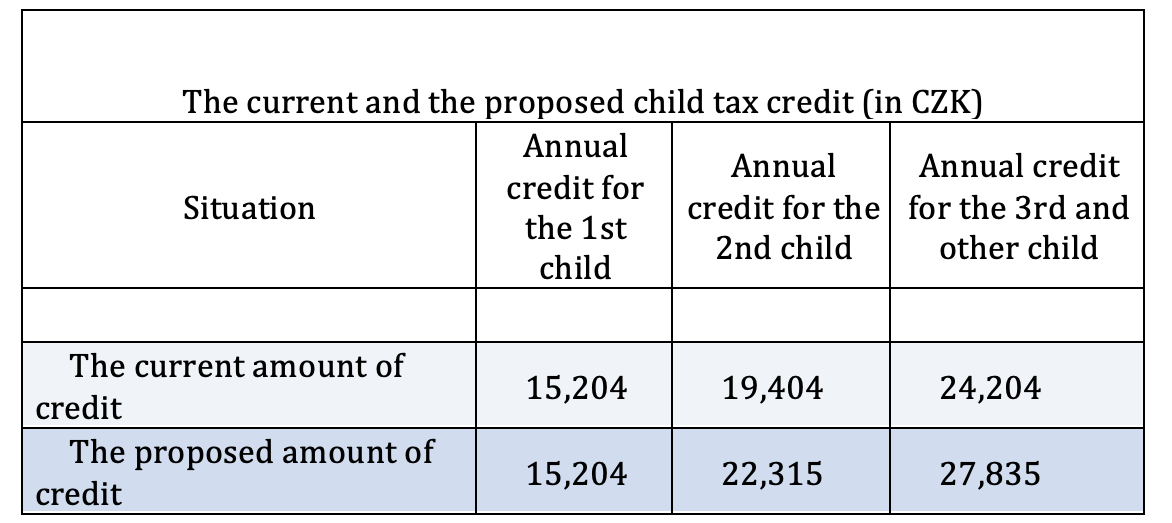

The Chamber of Deputies has approved an amendment of the act, when the tax credit for two and more children is to increase from 1 July 2021. The amendment being approved reckons with an increase of tax credit for the second, third and further children by 15 %. The tax credit for the first child would remain the same. In article 35c paragraph 1 of the ITA, the amount of “CZK 19,404” will be replaced with “CZK 22,315” and the amount of “CZK 24,204” with “CZK 27,835”.

The change needs to be approved by the Senate as well.

Petr Němec | 22.11.2024

Financial Statements for 2024 and Top-Up Taxes

Jana Shumakova | 12.11.2024

One-Stop-Shop: Easy VAT management for e-shops expanding abroad

Richard Knobloch | 5.11.2024

Major amendment to the VAT Act approved by the Chamber of Deputies