Taxes, accounting, law and more. All the key news for your business.

The amendments to Act on Income Tax adopted during the last two years brought several changes applicable for the tax periods 2017 and 2018. The most important changes concerning personal income tax are introduced below, in the first part of the overview we will offer you.

Higher ceiling for social security and basis for solidarity tax

The highest basis of assessment for social security insurance (an amount equal to 48 times the average wage) was CZK 1 355 136 for the year 2017. The same amount is decisive for the solidarity tax of 7% of income from employment and sub-base tax from self-employment if these surpass the mentioned amount. Solidarity tax is also linked with the obligation of Personal Income Tax return. The maximum basis of assessment has increased to CZK 1 438 992 for the year 2018. Therefore, the amount which compels employers in 2018 to add solidarity tax to the monthly advance tax is CZK 119 916 (4 times the average wage).

Tax advantage

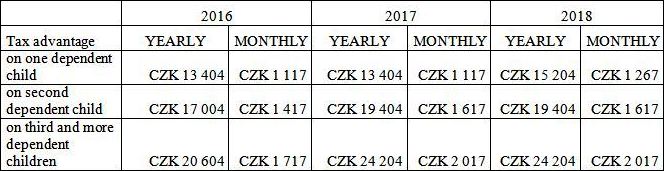

The amendment that came into force on July 1st, 2017 brought higher tax advantage on the second child and on the third and any more children. According to the transitional provisions, the new tax advantage will be applicable for the entire tax period of 2017. If an employee uses their tax advantage monthly in their employment, the employer should have applied the higher tax credit already for payroll for the month of June, 2017. Similarly, to last year, after submission of tax return or finishing of annual accounts even employees who apply tax advantage on the second child (and any more children) on a monthly basis will have overpaid in tax due to this (for months January to June, 2017). As of January 1st, 2018, tax advantage on the first child has also been increased by CZK 150 per month.

The table below shows the amounts of tax advantage applicable for the years from 2016 to 2018.

The maximum amount of tax bonus applicable by the payer for a given tax period was not changed and remains at CZK 60 300. However, with the beginning of the 2018 tax period, only “active income” will be considered for the bonus pay out, i.e. income from employment or from self-employment and not income from rent or capital assets.

Advantage for kindergarten placement

The maximum amount of advantage for placing a child in a pre-school institution is increased from CZK 11 000 to CZK 12 200 since January 2018 in connection to the increase of the minimum wage. The amendment coming in force for the 2018 tax period states that for the application of advantage for kindergarten placement the expenses for the actual placement in the given calendar year are decisive and not the moment of the payment itself. The amendment also provides for the confirmation issued by the institution. It should include not only the name of the dependent child and the amount of expenses for the tax period, but newly also the date of entry of the institution into the school registry or providers registry, and the date from which its license to trade is in force.

Tax advantage in connection to disablement and ZTP/P card

According to the former version of the Act the decisive factors for double advantage on a spouse, basic and broad advantage for disablement, advantage for ZTP/P card holders, or higher tax advantage were: if and since when has the disabled person been receiving disability pension, and in the case of ZTP/P the issue date of the card. From the 2018 tax period it will be possible to lower tax in connection to the disability pension granting itself, or the granting of the ZTP/P card.

Flat-rate expenditure

From the 2018 tax period the base amount for calculation of the maximum of the so called “flat-rate expenditure” has been lowered to CZK 1 million. This means that for self-employment income, for example, it will be possible to apply this type of expenditure only up to the amount of CZK 600 000. At the same time, however, a provision has been removed, the one limiting the possibility to apply advantage on the spouse and advantage for payers whose income tax base from self-employment and from rent (where they apply flat-rate expenditure) amounted to more than 50% of their total tax base. For the 2017 tax period taxpayers could choose whether they would follow the previous provision (i.e. higher maximum amount of flat-rate expenditure but without using the stated advantages) or the amended version. That is why we would recommend payers with higher income calculate their chosen option carefully, or alternatively consider the option of applying the actual expenditure. The option to choose is applicable also for income from rent in case of 30% applied flat-rate expenditure.

We will inform you about more changes to this area in some of the future issues of our newsletter. If you would like a consultation about these topics, we are here to help you.