Alice Šrámková | 28.1.2025

Series: New Accounting Act – Part I.Taxes, accounting, law and more. All the key news for your business.

We originally expected a lot of changes to labour law connected issues as of January 1st, 2018. However, the amendment to the Labour Code has been hindered upon its second reading due to the general election and its future is in the hands of the new and changed Chamber of Deputies. That is the reason why employees and employers will be more interested in the already agreed on partial changes to other provisions. Some came into force on January 1st, 2018, others in 2017 already. We will look at them mainly in connection to income tax returns for the year 2017. If some of these changes concern your payroll and you would like to get some detailed information, do not hesitate to contact our specialists!

Changes to income tax

Children

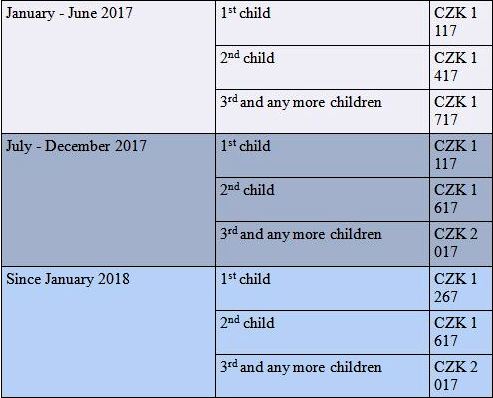

The year 2017 already saw an increase in advantage on the second child (from CZK 17 004 to CZK 19 404 per year) and the third and any more children (from CZK 20 604 to CZK 24 204 per year). The new monthly advantage has been applicable since July, 2017. In the yearly tax calculation (or return) the higher advantage can be applied for the entire year of 2017 and the overpaid amount for the first half a year can be gained back.

To make changes like this halfway through the year seems illogical and it brings along a lot of red tape, but it is a popular topic and affects many of the working people. Almost everybody will want a yearly calculation to apply this advantage in retrospect.

As of January 1st, 2018, the advantage on the first child is increased from CZK 13 404 to CZK 15 204 (per year).

Overview of the development of monthly tax advantage

ZTP/P card holders, disabled persons

The decisive moment for the existence of the claim has been changed. The claim will not start from the moment of issuance of the card or from the moment the disability pension starts being paid but already in the moment of the decision of the court. This is to avoid the “unfairness” which arises as a result of the various durations of the formal time period between the court’s decision and the card issuance or the first payment.

This is applicable also for advantage on a dependent spouse who is a ZTP/P card holder and the same advantage for such child, as well.

Withholding tax from income up to CZK 2 500

So far, we have been used to applying the withholding tax to income from agreements for work for those employees who have not filled out and submitted the declaration of the taxpayer and whose income has not exceeded CZK 10 000 per month.

Newly, the withholding tax is applicable to income from other agreements (employment contract, agreement of work activity - DPČ) if the employee has not filled out and submitted the declaration of the taxpayer and their income has not exceeded CZK 2 500 per month.

Advantage on kindergarten placement - change in assessment

Newly, this advantage will be applied according to the accrual principle, much like double-entry accounts. It will be advantage on payments expended for a certain tax period not actually paid in the given tax period.

Pension

These changed provision have been in force since January 1st, 2017, but their effects will be visible to us at the beginning of 2018 upon tax calculation for 2017. The confirmation of payments must now include not the total sum paid but the individual monthly payments in order to allow for finding of the amount of tax deduction.

Blood and bone marrow donation and deductions from the tax base

The unpaid donation of blood or its components, which the donor can deduct from the income tax base, is now rewarded by a higher amount (instead of CZK 2 000 it is now CZK 3 000). A new deductible item of CZK 20 000 has been introduced for a donation of hematopoietic cells (bone marrow). Deductions from the income tax base of these amounts can be applied in the yearly tax calculations for the year 2017 already.

Electronic declaration of the taxpayer

The amendment to the Act on Income Tax clearly states that the declaration of the taxpayer (so called “pink form”) can be filled out and submitted by employees electronically. The financial administration is a little behind and has issued instructions about how this declaration should look as late as the end of October 2017. There are also instructions for declaration forms for the following tax period and for the request for yearly tax calculation. The issued instructions state how the paper forms should look like for the year 2018 and how the xml file should look like for the electronic submission.

For the employer to be able to collect their employees’ declarations electronically, the employer needs to make sure to collect evidence about who and when has made the declaration and what were its contents. For example: employees could sign into a software system of the employer using their unique login details and fill out required information and confirm their correctness and veracity. We are also preparing something new for you in this area so stay tuned!