Taxes, accounting, law and more. All the key news for your business.

| May 23, 2023

Proceedings I R 1/20 and I R 2/20, among others, are currently pending before the Federal Fiscal Court on the conformity of Sect. 11 of the German Investment Tax Act (GITA) 2004 with European law. The question is whether there is unequal treatment with regard to the free movement of capital if, on the one hand, a foreign investment fund that receives dividends from domestic stock corporations and is subject to limited tax liability with these dividends and, on the other hand, a domestic investment fund is exempt from tax under Sec. 11 para 1 sent. 2 GITA (old version). However, it is questionable whether this difference in treatment is justified by coherence and the need to maintain a balanced distribution of taxation powers. The lower court of the Hessian Finance Court (judgments of 21th August 2019) had still considered the unequal treatment to be justified by the coherence of the tax system.

Thus, in its guiding principles to the judgment of 21th August 2019 - 4 K 999/17 EFG 2020 page 462, the Hessian Finance Court stated that the different treatment of foreign and domestic investment funds due to the tax exemption of only domestic investment funds under Sec. 11 para. 1 GITA was not contrary to European law. A violation of the free movement of capital contrary to European law is ruled out because the superficial unequal treatment of domestic and foreign investment funds in an overall view leads to the regulation being justified in any case by coherence and also because of the need to maintain the balanced distribution of tax powers between the Member States. There is a direct link between the taxation of the investment fund and the shareholder; taxation at the level of the shareholder (principle of transparency) compensates for the non-taxation of the domestic investment fund. In accordance with the principle of proportionality, unequal treatment in the tax credit is to be compensated primarily by an interpretation in conformity with European law, in this case Sect. 4 para. 2 GITA.

The ECJ declares the taxation of German real estate income in foreign real estate funds, which is applicable until the end of 2017, to be contrary to European law and ruled in its judgment of 27th April 2023 that the different treatment of domestic special funds and foreign investment funds under the Investment Tax Act 2004 was not compatible with the free movement of capital.

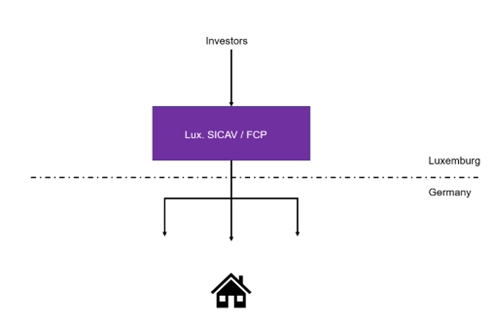

The background to the proceedings (C 537/20) was that until 2017, domestic special funds were exempt from corporation tax under Sect. 11 para 1 sent. 2 GITA (old version) and income from the investor was taxed, while in the case of foreign real estate funds, German real estate income was already recorded for tax purposes at fund level.

With regard to the admissibility of the regulation, which was in force until 2017, it was argued that in both cases the income earned by foreign investors in Germany was taxed only once, albeit at different levels, namely at investor level in the case of the German special fund, while at fund level in the case of foreign real estate funds. Due to the principle of territoriality, Germany was not able to levy a tax on foreign funds at investor level.

However, the ECJ has seen a disadvantage against foreign special real estate funds in violation of European law. There was a restriction on the free movement of capital because, under the Investment Tax Act 2004, domestic special real estate funds were exempt from corporation tax, while foreign funds were not. That difference in treatment was likely to discourage non-resident special real estate funds from investing in real estate located in Germany and to discourage investors resident in Germany from using non-resident special real estate funds for such investments. In particular, in the case of German investors in foreign real estate funds, an additional income taxation was added to the limited corporation tax liability of these funds at investor level, which was only inadequately eliminated by the existing crediting option.

The difference in treatment was also not considered justified. In that regard, the ECJ states that it would have been possible to maintain the internal coherence of the tax system if non-resident special real estate funds had been exempt from corporation tax, provided that the German tax authorities, with the cooperation of those funds, had ensured that the investors in those funds pay a tax equivalent to that to which the investors in a resident special real estate fund are subject.

A Member State which chooses not to tax the domestic income of resident funds cannot invoke the need for a balanced sharing of tax sovereignty between Member States.

Authors: Melanie Gieseler melanie.gieseler@de.gt.com, Torsten Schrimpf torsten.schrimpf@de.gt.com