Taxes, accounting, law and more. All the key news for your business.

| June 9, 2021

In this article, we would like to acquaint you with an interesting topic related to changes in the so-called tax package 2021 (act no. 609/2020 Coll.) in the case of act no. 586/1992 Coll., on income taxes (hereinafter the “ITA”), in connection to non-current assets and their impact on account keeping. The tax package has brought three major changes. The first change is the increase in the limit amount for categorizing tangible assets and technical improvements. The second major change is the introduction and the option of using extraordinary depreciation for the 1st and 2nd depreciation groups of non-current assets. The third change is the cancellation of the category of intangible assets according to article 32a of the ITA and thereby also the tax depreciation of intangible assets.

The amendment of the Income Tax Act was approved in December 2020 with the option of retroactive application as from 1 January 2020, in case the accounting entity chooses to do so. The changes apply obligatorily to assets acquired after 1 January 2021, regardless of whether accounting entities use a calendar year or a fiscal year.

Increase in the limit amount for categorizing tangible assets

The Income Tax Act has raised the limit amount for categorizing of non-current tangible assets (hereinafter the “NTA”) from CZK 40,000 to CZK 80,000 for separate moveable things and adult animals, including their groups. The limit for categorizing has been raised from CZK 40,000 to CZK 80,000 for technical improvements as well. Other types of non-current tangible assets are unchanged.

What does this mean for us in practice?

1. We buy tangible assets in the year 2021

a) Price < 80,000

• the limit within the internal guidelines of the company remains unchanged (we have for example CZK 40,000) for NTA, and thus for assets included in the accounting with an acquisition price between CZK 40ths and CZK 80ths, accounting depreciation equals tax depreciation

• the guideline will move the limit for NTA to CZK 80ths and it is then possible to make a one-time depreciation of everything acquired that will be up to CZK 80ths into costs

• if these are assets included in the 1st or 2nd depreciation group, we can use extraordinary depreciation

b) Price > 80,000

• if we change the limit in the guideline for reporting NTA to CZK 80,000, we then proceed according to the tax package and the change in the ITA

• if these are assets included in the 1st or 2nd depreciation group, we can use extraordinary depreciation

2. We buy tangible assets in the year 2020

a) Price < 80,000

• the limit in the guideline for NTA remains unchanged and we proceed according to the old version of the ITA

• if we move the given limit in the internal guideline, but not to the amount of CZK 80,000, we will be making accounting depreciation of objects with acquisition prices higher than the limit for activating non-current assets (for example CZK 20ths), and accounting depreciation then equals tax depreciation

• if these are assets included in the 1st or 2nd depreciation group, we can use extraordinary depreciation

• if we move the limit in the internal guideline to CZK 80,000, we can then put assets into tax eligible costs in a single step

b) Price > 80,000

• if we move the limit for NTA in the internal guideline to CZK 80,000, we proceed according to the new version of the ITA

• if it is a type of an asset in the 1st or 2nd group, we can use extraordinary depreciation

• the limit within the guideline remains unchanged (we have for example CZK 40,000) for NTA, and thus for assets included in the accounting with an acquisition price between CZK 40ths and CZK 80ths, accounting depreciation equals tax depreciation

This change does not apply to accounting depreciations, though, which are reflected in the accounting of accounting entities and thus they directly influence the profit/loss of the given accounting periods. Accounting depreciation is set by every accounting entity itself in its guideline according to the expected useful life and significance and it is independent of the ITA. Internal guidelines are always valid as of the first day of the accounting period and any retrospective change is very problematic and in this case we may even say unfeasible (it is not possible to change limits for reporting NTA retrospectively in the accounting). In practice, we unfortunately often encounter the limit for reporting NTA being subordinated to the ITA. This fact is not in compliance with accounting principles, though, especially with the true and fair presentation of the accounting.

We can apply all expenses (costs) of technical improvements, if they do not exceed the limit of CZK 80,000 in total for an object, as a tax expense from 1 January 2021. Technical improvement is understood to mean expenses on completed superstructures, extension and construction adjustments and modernisations of assets.

It follows from the above that this “tax” principle of raising value from CZK 40,000 to CZK 80,000 for NTA according to the ITA may also be applied retroactively for tangible moveable assets acquired between 1 January and 31 December 2020 and for technical improvements completed by the end of the year 2020, that is for the taxable period of the year 2020. These cases are resolved by transitional provisions. For NTA acquired from 1 January 2021 and technical improvements for NTA completed after 31 December 2020, the taxpayer has no choice anymore.

Introduction of extraordinary depreciations for the 1th and the 2nd depreciation group

In case of extraordinary events, the state may proceed to extraordinary measures. One of such extraordinary measures relating to the Covid 19 is the introduction of extraordinary depreciations of non-current assets.

Article 30a of the ITA - Extraordinary depreciations, states that the taxpayer may proceed to applying extraordinary depreciation for tangible assets categorized in depreciation group 1 and 2 according to Annex no. 1 of the ITA. Rules for application:

1. assets need to be categorized between 1 January 2020 and 31 December 2021

2. the taxpayer must be its first depreciator

3. the asset must be completely new

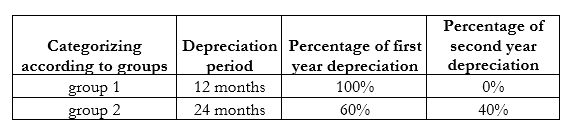

If the assets meet these criteria, the taxpayer will linearly depreciate 100% of the value (input price) of the asset without interruption in the course of 12 to 24 months, depending on the related depreciation group.

The depreciation is determined with precision to entire months and depreciation will begin on the following month after the day, on which the conditions for depreciation were fulfilled.

It is further necessary to point out that technical improvements of non-current intangible assets depreciated by these extraordinary depreciations do not increase their entry price. Technical improvement is categorized into a depreciation group together with the tangible assets it relates to, and will be depreciated linearly or using accelerated depreciation.

Cancellation of the category of intangible assets under article 32a of the ITA and thereby also tax depreciation

Prior to the introduction of the tax package, the limit for non-current intangible assets (NIA) was set by the ITA at CZK 60,000 with useful life longer than one year. Assets categorized in this way before the amendment took effect will be depreciated by the accounting entity according to the original act before the change. Accounting entities frequently, same as in case of NTA, followed the stipulations of the ITA.

From 1 January 2021, the category of non-current intangible assets under article 32a of the ITA is cancelled and “tax” depreciations are newly based on act no. 563/1991 Coll., on accounting and on internal guidelines of the accounting entity, which specify, in what way intangible assets are depreciated. These accounting depreciations are tax-eligible costs. Tax depreciation is thus cancelled for non-current intangible assets, according to the amendment of the ITA. For the purposes of the NIA, we work on the basis of the accounting act, which stipulates that the set NIA depreciations cannot be interrupted and we can set them separately for individual types of non-tangible assets. This stipulation can also be applied retrospectively for NIA included among assets from 1 January 2020 already, and again the above-mentioned information applies here about the very difficult applicability of a retroactively performed change in internal guidelines. The cancelled stipulation also treated technical improvements of NIA, for which the same rules will now apply as for the NIA.

For non-current intangible assets acquired in the course of the year 2020, the accounting entity may again use several options for tax depreciations. Among other things, it may leave assets categorized in NIA and depreciate it according to the original act. Technical improvement of these intangible assets completed after 1 January 2021 and later will increase the value and will be depreciated according to the TA applicable before this tax package.

What to say to conclude……

The purpose of the above-mentioned changes is to enable the taxpayer to apply higher tax base in these difficult times. We suppose that especially extraordinary depreciations will be widely used by accounting entities. The legal regulation relating to non-current intangible assets may bring greater complications for an accounting entity. The accounting entity will have to monitor, for what asset technical improvement is performed and if its depreciation will follow the cancelled article of the ITA (applicable before the tax package) or newly the Accounting Act. It is further very important, how the accounting entity specified the individual asset entries in its internal guideline, and any change performed between accounting periods not only within the limit set for reporting NTA/NIA must justified well/supported with arguments. The accounting entity should not change the limit for reporting non-current tangible and intangible assets only based on the changes performed in the ITA, because these are two different perspectives (approaches).