Taxes, accounting, law and more. All the key news for your business.

At the end of May this year, the Ministry of Finance issued the new Guidance D - 34 concerning transfer pricing. According to the authors, “the Guidance was issued in response to the 2017 updated version of the OECD Transfer Pricing Guidelines. The principles stated in this Guidance reflect the approach and attitudes from the time before the update, and they also add and specify readings of certain sections of the updated OECD guidelines.”

The updated OECD Transfer Pricing Guidelines include findings from the OECD BEPS Project (Base Erosion and Profit Shifting), specifically from actions 8, 9, and 10. The BEPS Project brought important modifications of the Guidelines, mainly as concerns the basics of transfer pricing itself. The “new guidelines” specify risk allocation, stress the economic substance of assets and transactions, and bring a new point of view of fees on utilization of intangible assets, of financial transactions, of intracompany service pricing, and of cost contribution arrangements. New point of view is also given to the substance of commissary contracts, and the rules for assigning profit to permanent establishments have been updated. Last but not least, changes have also been made to the transfer pricing documentation itself, specifically to the requirements regarding Master File and Local File. New principles are forming as regards closer cooperation between financial authorities of individual states in the area of exchange of information. There are also adjustments of the procedures in the so called conciliation procedure in the area of preliminary pricing agreements and subsequent changes of tax bases. In relation to this it is good to mention the introduction of the effect of the so called arbitrary convention on the avoidance of double taxation in relation to subsequent profit adjustments.

The Guidance specifies that what shall be used in practice is the commentary for the model convention, or rather the commentary for the period which corresponds in meaning with the text of the convention in question. Thus, it is not possible to apply new, updated commentaries and interpretation to conventions signed in the past if there are differences in meaning between the studied article and the version of that article in the model convention.

Every transaction between linked enterprises is subject to three types of tests during tax assessment:

The benchmark analysis represents the core of the arm’s length principle and is based on comparing the conditions of said transaction with conditions which would be established between independent entities under comparable conditions and circumstances. As it was in the past it is still necessary to compare the transaction according to the following comparability factors:

Another novelty is the DEMPE test, which is used to assess who is the owner of intangible assets from an economic point of view, and who is responsible for the risks associated with those assets. This means that besides examining the legal ownership and financing of intangibles, it is also necessary to ascertain who carries out the following functions:

The economic owner of intangible assets has a right to the profits following from the use of the intangibles and at the same time is obligated to subject these profits to taxation. However, if one party of the transaction is the legal owner of the intangibles, for example only providing financing for development of functions but does not carry them out or bear the risks associated with them, then not all the profits from the intangible assets belong to this party. In such a case, the right to the profits goes to the linked enterprises which perform these functions and at the same time carry the risks associated with the assets. The legal owner in this case has a right to reimbursement associated with the provision of capital only.

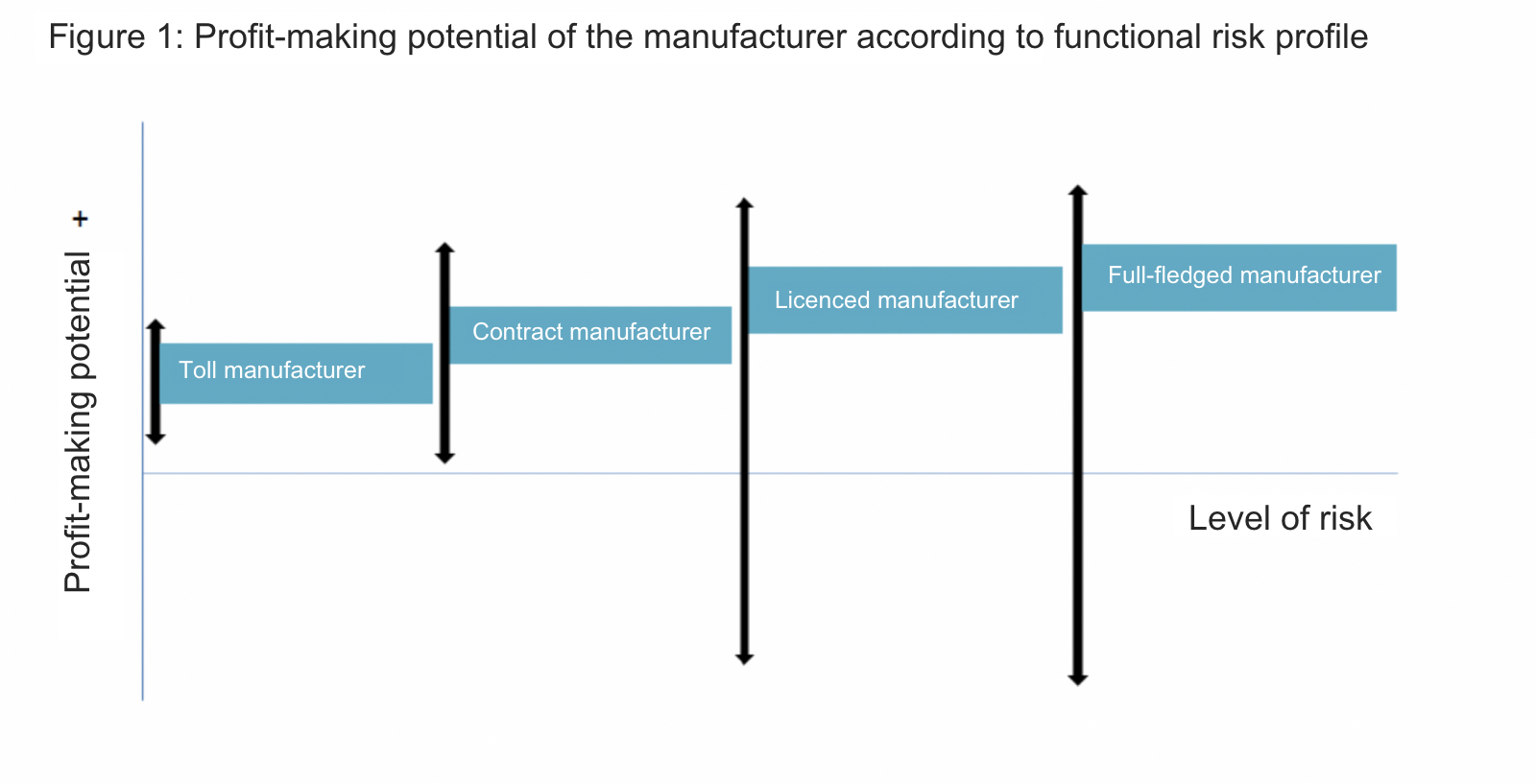

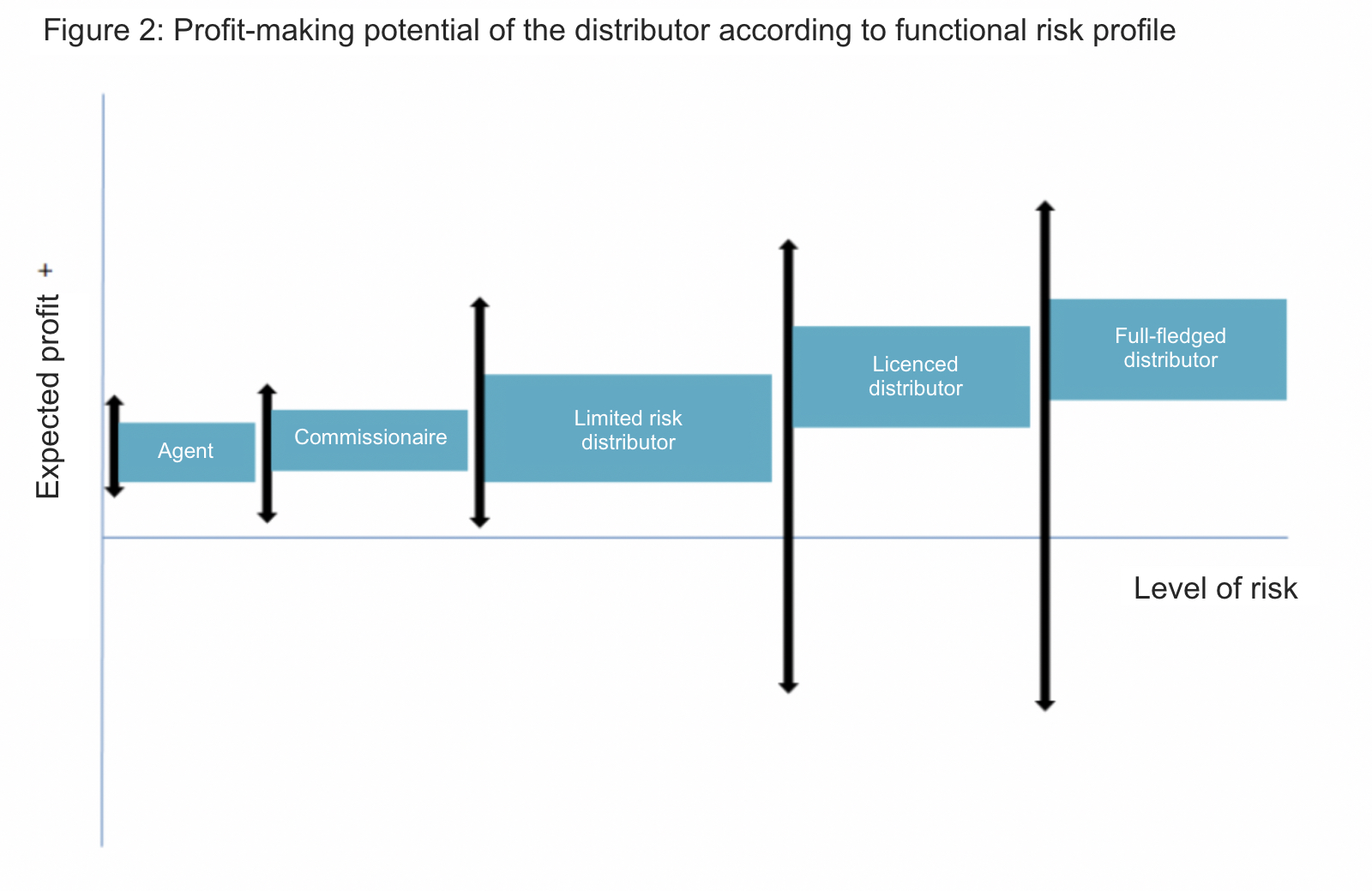

The typology of functional profiles for manufacturers and distributors is depicted in the following schemata. It is true that it’s not possible to precisely define the line between individual profiles and there will be a number of situation where an entity does not fit exactly into any of the definitions stated below. What matters is that in all cases the final reimbursement for every type of enterprise must reflect the functions it actually carries out, the associated risks, and used assets. It is, of course, true that the bigger the risks and the greater the independence, the bigger the profit.

The Guidance also contains a 7-step method for identification of reliable, comparable data. It also briefly describes the methods used for the determination of transfer prices. Another new Guidance, D-35, is currently being prepared which will focus on the reading of Transfer Pricing Documentation. Guidance D 34 is a replacement for Guidance D 332 from 2009.

If you’re interested in consultations regarding these issues, please do not hesitate to contact us.

Ivan Fučík & Štěpán Hrubý