Taxes, accounting, law and more. All the key news for your business.

From the headlines in the media in recent weeks, it may seem that the market for electromobility is experiencing a significant cooling after several years of rapid growth. There are reports of lower electric car sales in the first quarter than the carmakers had planned for. Are we witnessing the beginning of the end of electromobility? Let's take a closer look at the market situation.

In the EU context, there have never been more new pure battery electric vehicles (BEVs) nominally registered than in the first quarter of this year. So, in absolute terms, the electromobility market is still growing. However, the market has indeed cooled down in the last two months, mainly due to the cancellation of subsidy programmes for the purchase of electric vehicles in the neighbouring Germany. Despite this, the share of passenger electric cars in the total number of newly registered vehicles in the EU has remained at 12%.

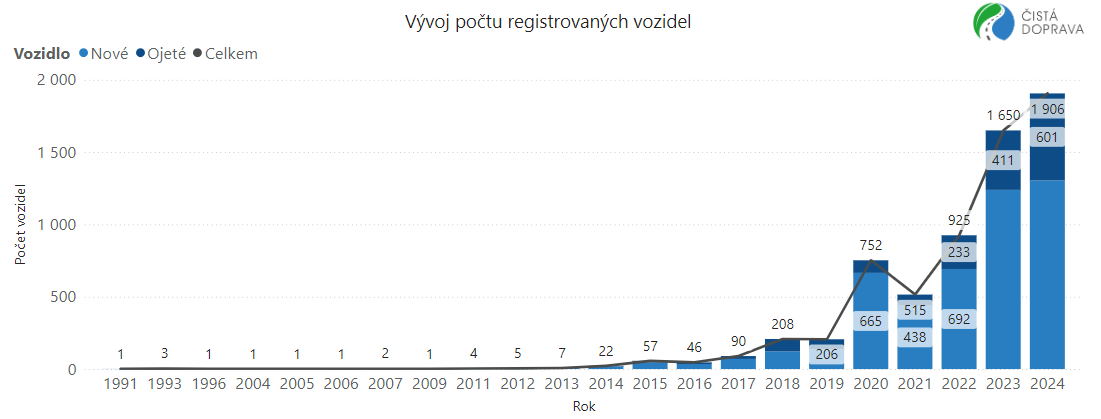

This cooling is hardly noticeable on the Czech market. In the first quarter, the number of registrations of new and especially used electric vehicles grew, as illustrated in the chart:

In the context of the Czech Republic, however, it is necessary to take into account that the market is growing from a very small base. The Czech Republic still lags behind Western European countries in electromobility. It is the growth of used cars that points the way for electromobiles to reach a wider range of drivers in the future. Currently, 73% of electric vehicles are purchased by company fleets, which replace these vehicles after four to five years at the latest and release them on the secondary market. This trend can be expected to intensify with the introduction of non-financial reporting (ESG) by companies from 2026. One of the easiest ways to comply with ESG reporting is to purchase an electric vehicle for the company fleet. The secondary market for electric vehicles can therefore be expected to accelerate in the next five years.

In conclusion, it can be stated that the sales of electric vehicles have cooled down and this trend can be expected to show in our market as well, with some delay. However, this is a slowdown in growth, which we consider to be short-term. Given the subsequent EU regulations on non-financial reporting by companies and the support allocated to electromobility under national subsidy programmes, further market growth can be expected in the long term.