Taxes, accounting, law and more. All the key news for your business.

Libor Schovánek | | October 19, 2021

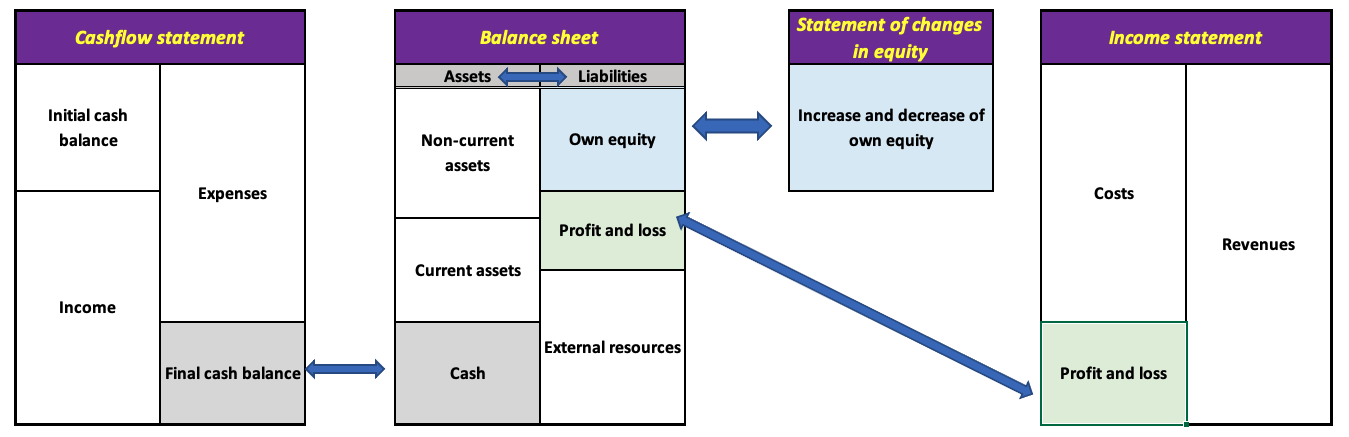

There are a number of control and logical links in the accounting, and the failure to adhere to them indicates an error or inaccuracy, which the accounting entity must resolve immediately. In the following overview, we state some basic links and the related errors.

In this part, we will first mention the links between the individual accounting reports, and in the continuation, we will then mention the context within the individual areas of account keeping itself.

Links in accounting reports

A) The basic control link on the balance sheet is equality: ASSETS = LIABILITIES

Assets represent economic sources and property of an accounting entity and they are expected to bring financial benefits and future gain. Liabilities may be characterised as sources for financing the assets of the company and they inform about what resources the assets of the company were bought with.

Description of the link – profit and loss connects the balance sheet and the income statement, and the values in both reports must therefore be identical. If they differ, this control link tells us that we have compiled one of the reports incorrectly and it is therefore necessary to check the compilation, find the reason for the difference and remove the error. Same as in case of the previous control link, one of the reasons may be a newly set-up account in the ledger and the fact that has not been “mapped into” the respective line of the balance sheet or it is being mapped in several places (duplicity), or also the already mentioned rounding-off in the individual lines of reports when recalculating data in thousands of CZK.

B) Link between the balance sheet and the profit and loss statement (“the income statement”)

The profit and loss for the current accounting period stated in line A.V. in liabilities on the balance sheet must equal the profit and loss for the accounting period in the profit and loss statement on the line marked ***

Profit and loss represents the difference between costs and revenues. In case of a positive result, we speak about profit of the accounting entity, a negative result means loss. A profit increases the accounting entity's own sources of asset coverage, while a loss decreases the entity's own sources of coverage.

Description of the link – profit and loss connects the balance sheet and the income statement, and the values in both reports must therefore be identical. If they differ, this control link tells us that we have compiled one of the reports incorrectly and it is therefore necessary to check the compilation, find the reason for the difference and remove the error. Same as in case of the previous control link, one of the reasons may be a newly set-up account in the ledger and the fact that has not been “mapped into” the respective line of the balance sheet or it is being mapped in several places (duplicity), or also the already mentioned rounding-off in the individual lines of reports when recalculating data in thousands of CZK.

C) The link between the balance sheet and the cash flow statement („CF“)

Cash (balance sheet report - line C.IV. previous period) must equal the initial balance of cash (CF report – line P.).

Cash (balance sheet report - line C.IV. current accounting period) must correspond to the final balance of cash (CF report – line R.).

Cash and cash equivalents represent money in the cash count, liquid valuables, cash in transit and cash balances registered in bank accounts.

Description of the link - the cash-flow statement captures for us the individual cash flows in the course of the accounting period, which took place at the accounting entity. Connection with the balance sheet is provided by this link, or by two links, i.e. the initial and the final cash balance must be identical to the balances stated in the cash flow statement.

D) Link between the balance sheet and the statement of changes in owner’s equity („OE“)

The individual components of owner’s equity (previous accounting period) posted on the balance sheet must equal the initial balances of the individual components of owner’s equity in the statement of changes in OE.

The individual components of owner’s equity (current accounting period) posted on the balance sheet must equal the final balances of the individual components of owner’s equity in the statement of changes in OE.

Owner’s equity represents the accounting entity’s own source of asset coverage. The accounting entity acquires it from the owners as well as through its own activity. It consists of the following basic groups: registered capital, capital funds, funds created from profit and the profit/loss.

Description of the link - the statement of changes in owner’s equity states the value of increments and decrements of the individual components of owner’s equity during the accounting period. It is therefore logical, then, that the links between the initial and the final balances of the individual components of owner’s equity in both reports, or the year-on-year change in the balances, must therefore correspond to one another. Differences may arise between the two reports for example due to rounding-off of amounts or human error (incorrect classification in a respective OE group). Movements of the individual components of owner’s equity must also be duly explained in the notes to the financial statement.